Student Loan Repayment Options

Consolidating your Federal Student Loans gives you a few different Student Loan Repayment options. For some basic information on them, you can see our FAQ. This page is designed to explain how the calculations are made, and also to assist you on when it may be wise to choose one repayment plan over another. Each has their benefits, and we here at Solevio let our clients make the final decision as to which option they think will benefit them the most in the short and long term. The four repayment plans are the Standard Repayment, Graduated Repayment, Income Contingent Repayment, and finally, the Income Based Repayment.

Income Based Repayment

The Income Based Repayment plan is by far the unique in the Student Loan Forgiveness program, and often the most beneficial. There are many benefits to the program, one of which is forgiveness on the first three years of unpaid interest from when you enroll into the Income Based Repayment plan for the subsidized portion of your loan. This works out for many to be a form of instant forgiveness on their loans because otherwise this interest would be due. For example, someone with a loan amount of $40,000 and an interest rate of 6.8% would have $8,160 of interest forgiven in their first three years from when their Income Based Repayment begins. This is assuming you qualify for a zero payment. If your payment is not zero, it is likely you are not completely paying off the monthly payment, and receiving forgiveness on the difference. Another benefit of the Income Based Repayment is that it offers, typically, the lowest payment for borrowers in financial hardship. The amount of your payment can never exceed 15% of your adjusted gross income over the poverty line for your family size. If you are married and file jointly, your spouse’s student loan indebtedness can be taken into account that can further lower your payment. You may want to take advantage of an Income-Based Repayment if

- You are having a financial hardship and would like some breathing room

- You qualify for a payment of zero or payment of less than the monthly interest payment on the loan. This will allow for that interest to be forgiven on the first three years

- You do not see a large increase in you income in the future, and see yourself always qualifying for a zero payment at which case your student loan would be completely forgiven at the end of the term.

The calculation for the Income Based Repayment is AGI – (Poverty Line x 150%) = Y (Y x .15) / 12 = IBR PAYMENT If you would like to see what your income based repayment could be, click here. Click here for additional information regarding the Income Based Repayment Plan

Standard Repayment

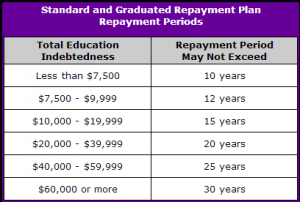

In the standard repayment plan, the payment on your loan is calculated like any normal loan payment, based up the size of the loan and also the term of the loan. The term is always based on the size of the loan, in which case you can use the chart below. Depending on your income and family size, the standard repayment plan can be a good option for you if

- You want to pay off the loan as soon as possible and currently have less than 30 years left on the term

- You do not qualify for an income-based repayment plan because of your higher income.

- Your loan amount is small enough where you can be paying a minimal amount over a short period rather than extending it for an additional X amount of years.

The standard repayment plan allows you to take care of your loans on time if you are making regular and full payments on them. You will pay less interest on a standard repayment plan than you will under the graduated. Often customers that do not qualify into either of the Income Based Repayment plans do not see a benefit of consolidating their loans into a Standard Repayment plan when their current payment can be nearly the same. This often is misguided as one of the major benefits of this consolidation is the flexibility with the repayment plans. If you come under hardship in the future, at any moment you can call us here at Solevio, and we will change your repayment plan to an Income Based Repayment plan. What this does for you allow you to have then a payment based on your income, which may prevent you from falling into default on your loans. In many cases, your payment can roll to zero on your loans. This is not a deferment status, which essentially pauses your term. You would have a zero payment for however long your hardship lasts, and the term continues to move forward. This is where the forgiveness aspect plays a large roll. Once your term is over your loan is completely forgiven. This is a huge benefit to the program that is often overlooked by our clients until we explain to them this benefit.

The calculation for the Standard Repayment Formula is:

![]()

Graduated Repayment Plan

The graduate repayment plan is similar to the standard repayment plan in its calculation, but the major difference is that for the first few years under the graduated plan you are only paying interest on the loan. For this reason, the graduated plan, in the beginning, is always less than the standard repayment plan. You start off only paying interest on the loan and after every two years, your payment increases. The term of the loan is the same as the standard and is based on your loan amount. You may want to choose the graduated plan if:

- Your income is high enough where the Income Based reprograms do not make sense for you, or you may not even qualify for them

- You want to have a slightly lower payment right now, knowing that your payments will slowly increase every two years until the loan is paid off.

- You expect your current job to have normal and regular pay raises and expect to be able to pay the increase of the payment every couple years without it putting undue hardship on yourself and your family.

One of the drawbacks of the Graduated Repayment Plan is that the total amount you will pay on the loan will be more than a standard repayment. This is because you are only paying off the interest for the first two years, and even into years 3-4 you may not be paying off the principal as fast as you would be in a normal amortization schedule. Thus, you are left paying more through the life of the loan with the benefit being lower payments to start off. Its also important again to stress the Forgiveness aspect of the loan. If at any time you cannot make the payments due to a job loss, or loss of income, Solevio can have your repayment plan changed for you so you do not suffer the hardship of making payments you cannot afford. During this time, your term would continue with a significantly lower payment, and at the end of the term, the loan would be completely forgiven. The calculation for the graduated repayment is: PMT = (Loan Amount * Interest Rate) / 12

Income Contingent Repayment

The Income Contingent Repayment plan uses a couple of income based factors to determine what your payment will be during your Student Loan Repayment. The Income Contingent Repayment plan calculates your payment two different ways, and then gives you the lower of the two payments. One calculation is your Adjusted Gross Income(AGI) over the poverty line for your family size, multiplied by 20% for an annual payment (divide by twelve for a monthly payment). This calculation does not take the loan size into account at all.

- Payment = ((AGI – Poverty Line) x 20%) / 12

The second calculation does use your loan value, and income factor determined by the federal government, and a constant multiplier also determined by the federal government. Then these are used to calculate your payment for the second method. Whichever of the formulas gives you the lower payment is used, and the other is disregarded. You may benefit from an Income Contingent Repayment Plan if

- You are suffering a financial hardship and need relief

- You do not see having a higher income in the future and would like to be eligible for student loan forgiveness. Under this repayment, it is not expected that at the end of the term will be paid off, so loan forgiveness is likely.